SEO strategy: 82% of Aussie consumers begin their buying journeys on search engines

How can eCommerce businesses gain a competitive edge by becoming more visible online and capture the attention of consumers by answering user queries more accurately?

Capterra’s Elusive Online Consumer study analysed the online shopping behaviour of more than 5,500 consumers across 12 countries globally, including nearly 500 Australian consumers to determine what affects the end-to-end customer journey from initial search to purchase.

Search engines are most popular for product search but are not without their challenges

Search engines are the primary destination where consumers begin their online search for products in Australia. About eight in ten (82%) Aussie consumers start their online search for products on search engines, followed by retailer websites (54%) and department store websites (38%).

Search engines are a traditional method of finding products or services online, which may indicate that Aussie consumers prefer tried and tested routes over other ways. While the favorability of search engines may also indicate their continued dominance as a source for discovery, consumers face many challenges when using these platforms to search for products or services online.

The top challenges relate to an overwhelming abundance of online search results that are difficult to navigate and refine. Survey participants cite the following challenges they have encountered with online product search results:

- Inaccurate or irrelevant results (63%)

- Too many sponsored ads or results (62%)

- Too many results (32%)

- Knowing which search terms to use (22%)

How to increase your online visibility and overcome search engine challenges with search engine optimisation (SEO) tools?

Businesses that optimise their web pages with SEO tools and techniques can increase the chances of online shoppers discovering their content when they type a search query into internet search engines. Optimising websites includes aspects such as incorporating relevant keywords into text, adding descriptive meta tags to images and video content, and improving page loading speeds.

Additionally, SEO-optimised websites will send positive signals to search engines to display content relevant to a user’s search query. Businesses should also consider conducting thorough keyword research when optimising their content to discover ranking, difficulty, and keyword gaps, to develop an SEO strategy.

Narrow down the customer journey per age group

Despite internet search engines being the most popular place to start a search—even among all generations—there is a considerable difference in use across different generations. Of the older generation respondents (boomers and Gen X), 86% say they use search engines to search for new products and services, followed by millennials (82%) and Gen Z (76%).

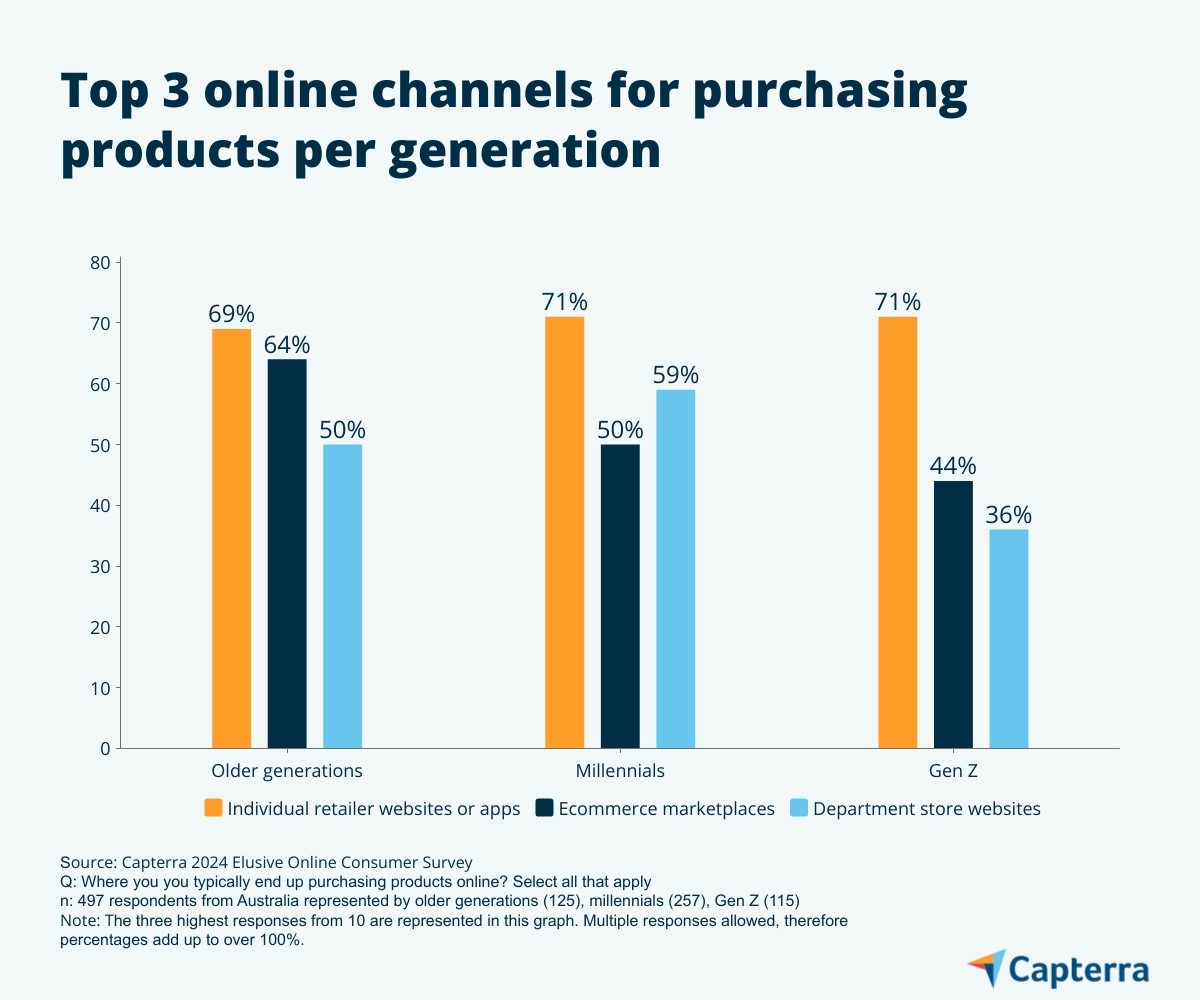

Further analysis of final purchasing channels where consumers typically end up making purchases also shows a difference between age groups. Predominantly, 70% of Australian online shoppers say they typically end up purchasing from individual retailer websites or apps. However, there are significant disparities between age groups for respondents who say they typically end up purchasing from eCommerce marketplaces and department store websites. As you can see in the graph below, older generations were more likely to cite eCommerce marketplaces, such as Amazon, than other generations.

Evaluate the customer journey and optimise visibility

The dynamic nature of customers’ online presence challenges businesses to implement a comprehensive marketing strategy that integrates various aspects of the customer experience.

A multi-faceted marketing approach is essential for retailers to properly target customers. Buyers have a dynamic psyche on preferences, whether on platforms or influences in purchase decisions. Businesses must bear in mind their target market and focus their efforts on optimising brand visibility.

By Andrew Blair, Analyst, Capterra