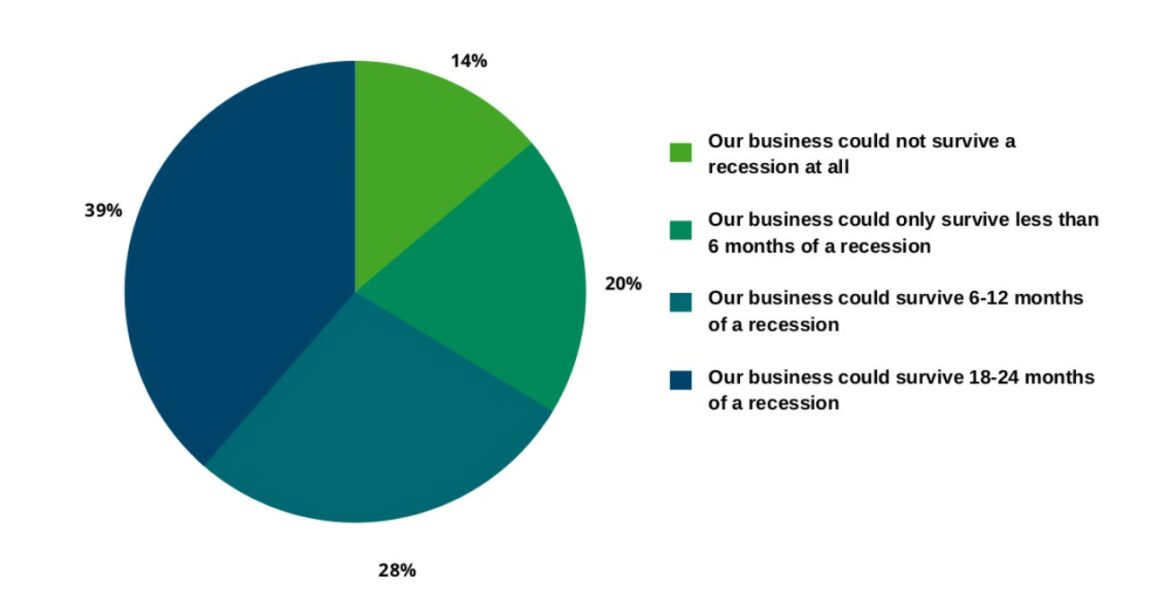

As financial experts continue to predict an Australian recession in the next two years, new research has found that 34 per cent of Aussie SMEs wouldn’t survive more than 6 months of economic downturn, with 14 per cent unable to survive a recession at all. Economists are facing a difficult choice to stabilise the economy, by either increasing interest rates significantly and putting banks and businesses at risk of defaulting on loan repayments or allowing inflation to rapidly increase and reducing consumer confidence and spending.

Aussie businesses are also torn about whether a recession or rising inflation would be more damaging to their businesses, as 55 per cent are more concerned with the impacts of a recession, while 45 per cent would be worse-off from continued rising inflation.

The findings were derived from a survey of an independent panel of 253 Australian SME owners, commissioned by Small Business Loans Australia, a free comparison website helping Australian business owners find the best financing and loan options in Australia. The full survey results, including breakdowns across ages and States, can be found here.

In the survey, Small Business Loans Australia asked respondents to forecast how long they could survive through a recession. Recessions are normally short and sharp. An example is the 1990 recession, which lasted 14 months1. Only 39 per cent of survey respondents would’ve made it through the previous Australian recession, predicting they could survive 18-24 months. Fourteen (14) per cent would not survive a recession at all, however short. One-fifth (20 per cent) admitted they would survive less than six months of a recession and one quarter (28 per cent) predicted they would survive just 6-12 months.

Alon Rajic, the founder and managing director of Small Business Loans Australia, says: “The survey results are concerning. Many Australian businesses have had to endure a tough two years of decreased margins and cash flow, due to operational limitations, lockdowns and lower consumer confidence. As a result, many SMEs are heading into a recession without a savings cushion or plan B. The sector is extremely resilient and my hope is that businesses have learnt from the pandemic to have some safeguards prepared to see the other side of this period.”

Concerningly, larger businesses were least equipped to combat the impacts of a recession:

31 per cent of medium-sized businesses (with 51-200 employees) said they could not survive more than six months of a recession, compared with 26 per cent of small businesses (with 11-50 employees) and 16 per cent of micro-businesses (with 1-10 employees).

“Recessions can affect businesses of all sizes, however, typically larger companies can have an extra financial buffer to fall back on, as it is normally easier for them to secure financing. It is concerning to see established businesses have a gloomy outlook on their ability to survive a recession.

“To minimise the impacts of a potential recession, I encourage SMEs to implement preventative financial practices now. Renegotiate vendor agreements and re-examine your accounting books to cut costs where possible. If SMEs are paying off business loans and have been affected by increased rate rises, consider consolidating debts and refinancing loans to secure a lower rate. Comparison services make good online research tools, and can help SMEs find an appropriate loan that will allow them to fix lower interest rates.”

Despite the majority of SMEs suggesting they wouldn’t be able to survive more than a year in a recession, only 55 per cent of respondents believed a recession would be worse for their business than continued rising inflation.

Small businesses would feel the effects of a recession the most, with 63 per cent believing an economic downturn would be worse for their business than inflation, followed by 53 per cent of micro-businesses and 51 per cent of medium-sized businesses.

Alon adds: “SMEs are the backbone of the Australian economy, and it is concerning that they continue to face many external factors, including a recession, that threatens the survival of their businesses. Ultimately, an economic downturn is predicted but not guaranteed and targeted government stimulus and investment in population and export growth could pull our SME market safely through this period of uncertainty. Businesses who proactively make changes and put practices and safeguards in place will also be able to survive and thrive beyond this tough period.”