Data and Credential Theft Malware are Top Two Cyberthreats Facing SMBs in 2023, Accounting for Nearly 50% of All Malware Sophos Detected Targeting this Market Segment

Ransomware Still the Biggest Threat to SMBs; Business Email Compromise on the Rise, Along with More Sophisticated Social Engineering Tactics

Sophos, a global leader in innovating and delivering cybersecurity as a service, today released its annual 2024 Sophos Threat Report, with this year’s report detailing “Cybercrime on Main Street” and the biggest threats facing small- and medium-sized businesses (SMBs*). According to the report, in 2023, nearly 50% of malware detections for SMBs were keyloggers, spyware and stealers, malware that attackers use to steal data and credentials. Attackers subsequently use this stolen information to gain unauthorised remote access, extort victims, deploy ransomware, and more.

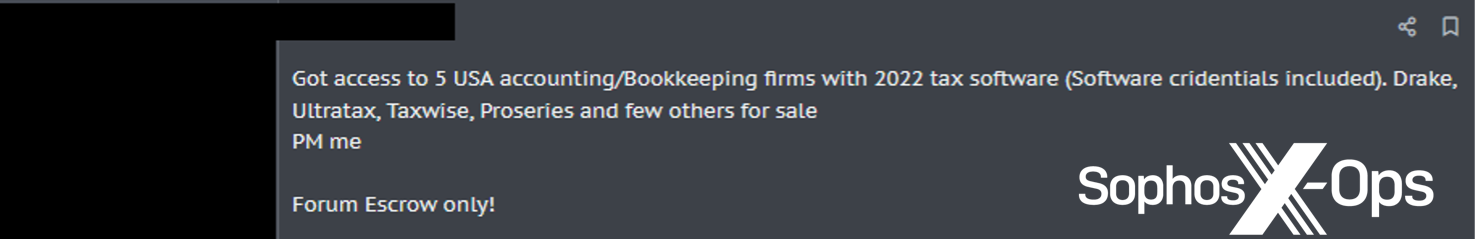

The Sophos report also analyses initial access brokers (IABs)—criminals who specialise in breaking into computer networks. As seen in the report, IABs are using the dark web to advertise their ability and services to break specifically into SMB networks or sell ready-to-go-access to SMBs they’ve already cracked.

Above: Discovered by Sophos X-Ops: a sample of a dark web forum post advertising access to a small U.S. accounting firm. Additional examples of cybercriminal forum ads targeting SMBs, by industry and country, are in the 2024 Sophos Threat Report.

“The value of ‘data,’ as currency has increased exponentially among cybercriminals, and this is particularly true for SMBs, which tend to use one service or software application, per function, for their entire operation. For example, let’s say attackers deploy an infostealer on their target’s network to steal credentials and then get hold of the password for the company’s accounting software. Attackers could then gain access to the targeted company’s financials and have the ability to funnel funds into their own accounts,” said Christopher Budd, director of Sophos X-Ops research at Sophos. “There’s a reason that more than 90% of all cyberattacks reported to Sophos in 2023 involved data or credential theft, whether through ransomware attacks, data extortion, unauthorised remote access, or simply data theft.”

Ransomware Still the Biggest Cyberthreat to SMBs

While the number of ransomware attacks against SMBs has stabilised, it continues to be the biggest cyberthreat to SMBs. Out of the SMB cases handled by Sophos Incident Response (IR), which helps organisations under active attack, LockBit was the top ransomware gang wreaking havoc. Akira and BlackCat were second and third, respectively. SMBs studied in the report also faced attacks by lingering older and lesser-known ransomware, such as BitLocker and Crytox.

Ransomware operators continue to change ransomware tactics, according to the report. This includes leveraging remote encryption and targeting managed service providers (MSPs). Between 2022 and 2023, the number of ransomware attacks that involved remote encryption—when attackers use an unmanaged device on organisations’ networks to encrypt files on other systems in the network—increased by 62%.

In addition, this past year, Sophos’s Managed Detection and Response (MDR) team responded to five cases involving small businesses that were attacked through an exploit in their MSPs’ remote monitoring and management (RMM) software.

Attackers Sharpen Their Social Engineering and Business Email Compromise (BEC) Attacks

Following ransomware, business email compromise (BEC) attacks were the second highest type of attacks that Sophos IR handled in 2023, according to the Sophos report.

These BEC attacks and other social engineering campaigns contain an increasing level of sophistication. Rather than simply sending an email with a malicious attachment, attackers are now more likely to engage with their targets by sending a series of conversational emails back and forth or even calling them.

In an attempt to evade detection by traditional spam prevention tools, attackers are now experimenting with new formats for their malicious content, embedding images that contain the malicious code or sending malicious attachments in OneNote or archive formats. In one case Sophos investigated, the attackers sent a PDF document with a blurry, unreadable thumbnail of an “invoice.” The download button contained a link to a malicious website.

For in-depth details about these cybercrimes and more targeting SMBs, please read the 2024 Sophos Threat Report: Cybercrime on Main Street on Sophos.com.