LoanOptions.ai is Australia’s easiest loan tool which was created to take the headache out of loan approvals.Backed by tech, LoanOptions.ai is Australia’s first artificial intelligence marketplace for personal, business and car loans.

Whether customers need a car loan, equipment loan, personal loan, business loan, or caravan loan, LoanOptions technology and lenders merge to provide the best marketplace which takes the stress out of what is a notoriously anxiety inducing process. The loan assessment tool is powered by artificial intelligence. This means that lender information changes in real time depending on the information that is added. The progress bar in the application continues to fill up as the user inputs more personalised information.

The biggest hassle when requesting a car loan, personal loan or business loan is the dreaded approval process.

Founder Julian Fayad explains: “We are Australia’s first ever AI powered loan comparison platform. We use data driven technology to pre-approve you with the most competitive loan from over 60 banks and lenders based on your personal circumstances.

LoanOptions.ai is the only platform that provides you with REAL quotes from lender offers that you actually qualify. Many other platforms just show the headline rate, but by the time you give them your information, you end up paying more. Our platform is designed to continuously recalculate the quotes each time you provide more information. It will only show you the offers that you qualify for. Our process doesn’t just hand you off, we actually see your loan through right to the end when the money is paid.”

Why is it so hard to get a loan post COVID?

It is more difficult to apply for a loan post COVID because lenders have become more strict on policy. Many employees lost their jobs and had to find additional jobs whilst some are still on reduced hours.

Julian adds: “We have more than 60 lenders on the platform and our AI accurately predicts which lenders will approve the client. This takes the complexity of trying to navigate 60+ lenders credit policies and more importantly prevents you from having to do multiple applications which could hurt your credit rating.”

Why is getting a loan so lengthy in Australia?

Australia has a highly regulated and stringent financial services industry. Whilst consumer protections are a good thing, this sometimes leads to lengthy paperwork, tedious processes and a lack of common sense being used in lenders approving loans. LoanOptions.ai is able to streamline the entire process and ensure all relevant options are presented in a fair and transparent way, leading to positive client outcomes.

Banks and lenders often use old school approaches

Julian says: “They still use physical signatures instead of digital signatures, they still use manual credit assessment which leads to long wait times, poor outcomes and poor customer experiences.”

- Fill in loan details

- Fill in personal details

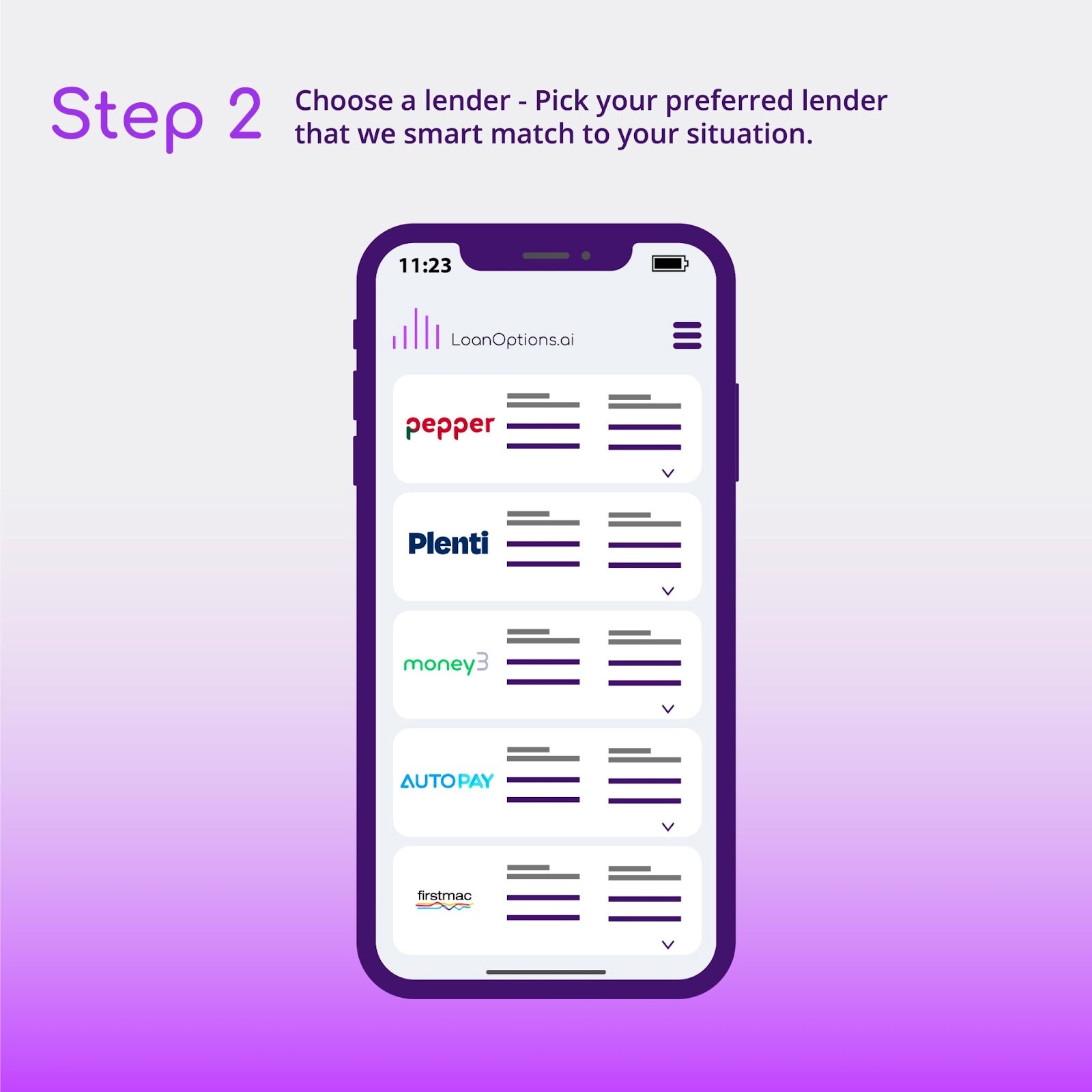

- Choose your lender

- Submit application

- We perform checks

- Loan approved